Such finance are dedicated to enabling those people who are low income and cannot pay for a timeless mortgage

You’ve got already been saving upwards for some time so you can manage a home. You may have actually considered that you had to attempt to own a large sum of money to reach resident condition. Although not, even with popular trust, there clearly was a means to sign up for home financing instead of a down-payment.

Continue reading while we walk you through the fresh new down-payment procedure, as well as bring insight about how to score a home loan no downpayment.

Old-fashioned Off Costs

Normally, if you are planning buying a house, you need to pay a percentage of one’s house’s prices initial. Off payments greatly affect the home loan procedure. They may be able connect with simply how much you have to pay inside the attention, whether or not your qualify for certain mortgages, and if take out Private Financial Insurance coverage.

Home loan off money cost you anywhere between 5 and 20% of one’s home’s price. Basically, the better the downpayment, the lower their Apr. Whenever you be able to lay at the very least 20% upon your property, you are going to open up lower Annual percentage rate options due to the fact lenders view you as a reduced amount of a risk.

Loan-to-worthy of proportion

Their deposit impacts the mortgage-to-really worth (LTV) cash advance usa Northwest Harwinton Connecticut ratio of your house. LTV are a ratio out-of how much cash the financial try as opposed to how much cash the house are appraised for. The reduced the LTV proportion, the reduced the risk so you can loan providers additionally the highest the right one to a home loan company usually accept the loan software.

Actually, of several lenders place a particular LTV ratio which they want having a home loan become secure that it decides their down-payment requirements.

Personal Mortgage Insurance rates

Personal home loan insurance policies (PMI) try insurance policies that is both called for when you take away a financial. How come that it’s crucial regarding down payments are one to PMI is commonly waived in the event the homeowners set out a straight down percentage off 20% or more. Will cost you of PMI are very different however, understand that for people who carry out decide for a lowered advance payment, your I.

For which you buy their home loan have a giant dictate into the constraints and requires to possess PMI as well. Borrowing unions, such as for instance Jeanne D’Arc, was user-centric and gives choices to pick residential property with lower than 20% down payments which do not need PMI.

Zero-Off Mortgages

Zero-down mortgage loans or mortgages that have 0% down repayments manage can be found. Yet not, they are usually bodies-backed fund. Talking about offered if you are struggling to buy property oneself. In such a case, the government plays the possibility of losing profits for individuals who standard on your own financial. There are two main top kinds of zero-down mortgages USDA and you can Virtual assistant.

USDA Mortgage loans

An effective USDA mortgage try a home loan option available with the us Service of Agriculture. These can be fund personally financed by authorities, otherwise finance awarded because of the playing loan providers.

USDA finance need you to has actually very good borrowing, and a credit history off 640 or even more commonly improve the fresh techniques.

Veterans Items Funds

Pros Products (VA) money was no % off mortgages set aside to possess people in the fresh United states military active otherwise past. The fresh limitation of them fund hinges on the region. Va funds are offered of the playing loan providers however they are supported by government entities.

Private enterprises

Certain private enterprises can get highlight zero-off mortgage loans. But be mindful, things that appear to be good to end up being genuine often are. Such mortgage loans come with quite high I, otherwise has actually too much closure costs.

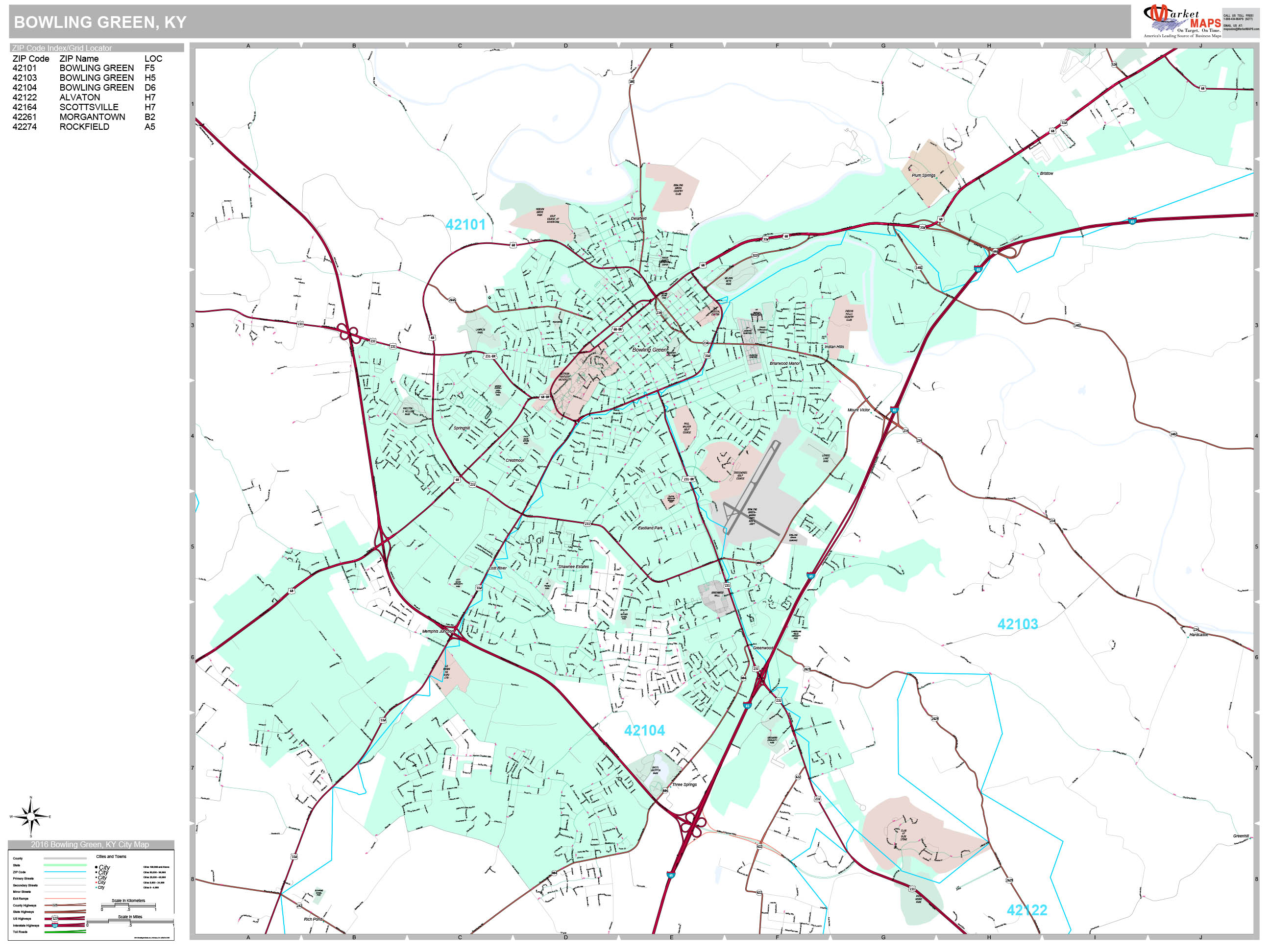

Based your area, your s in order to get the lowest downpayment otherwise help with their advance payment.

Like, for the Massachusetts, this new MassHousing program provides licensed earliest-day buyers with around a great 5% guidance mortgage for their downpayment. The newest MassHousing Process Invited Financial program also can be obtained to aid people in the army, experts, people in the fresh military put aside or Federal Guard which have a straight down payment direction loan and you will an effective $dos,100000 credit going toward closing costs.

On Jeanne D’Arc Credit Partnership, we know that it can be difficult to learn each one of the options and decide what is actually best.

Having ideas on ways to get the procedure already been, contact our very own financing officials. Let’s determine very first-time family client options, government mortgage apps, plus the advantages and disadvantages of large off costs. We’ll make sure that you’re alert to possibilities and you can confident in the choice.