What is actually good credit to have a house guarantee loan?

- Debt consolidation reduction

Merging your financial situation is when you’re taking out a loan and you can make use of the currency to invest straight back all your other expenses or many of them. Remortgaging your property to help you consolidate expenses is more prominent, but it is however you can having a house security mortgage. You merely make use of the currency to settle any loan providers you have. It may not become you can which have a good HELOC as you you need the capital initial.

There is a pattern out of more mature family relations being able to access their residence guarantee to simply help younger family members availableness most useful mortgages having more substantial put. They discharge collateral right after which provide the currency in order to family so they could get on the house ladder whether or not it could have maybe not started possible as opposed to its let.

House security mortgage qualification conditions

So you can be eligible for a house collateral financing, attempt to become at the least 18 yrs old having available equity (sometimes at least more than ?10,000 collateral) and become a beneficial United kingdom citizen.

But simply since you meet up with the qualification standards with available family security doesn’t mean you’ll be able to instantly be acknowledged on loan. Lenders will need to assess your ability to repay by lookin at the credit report and credit score. They will and additionally assess your income contrary to the matter we wish to borrow more than just what installment period, and analyse the debt to help you money ratio.

There is no one hundred% fixed credit score that you ought to get a home equity mortgage with all loan providers. Some advantages anticipate which you are able to you desire about a 620 to be tested on most loan providers. Additional loan providers may need a slightly highest rating, for example 640-680. Having best opportunity, you may want to try and improve your rating as much as a lot more than 740 before applying. That have increased credit score will get produce given a lowered interest rate.

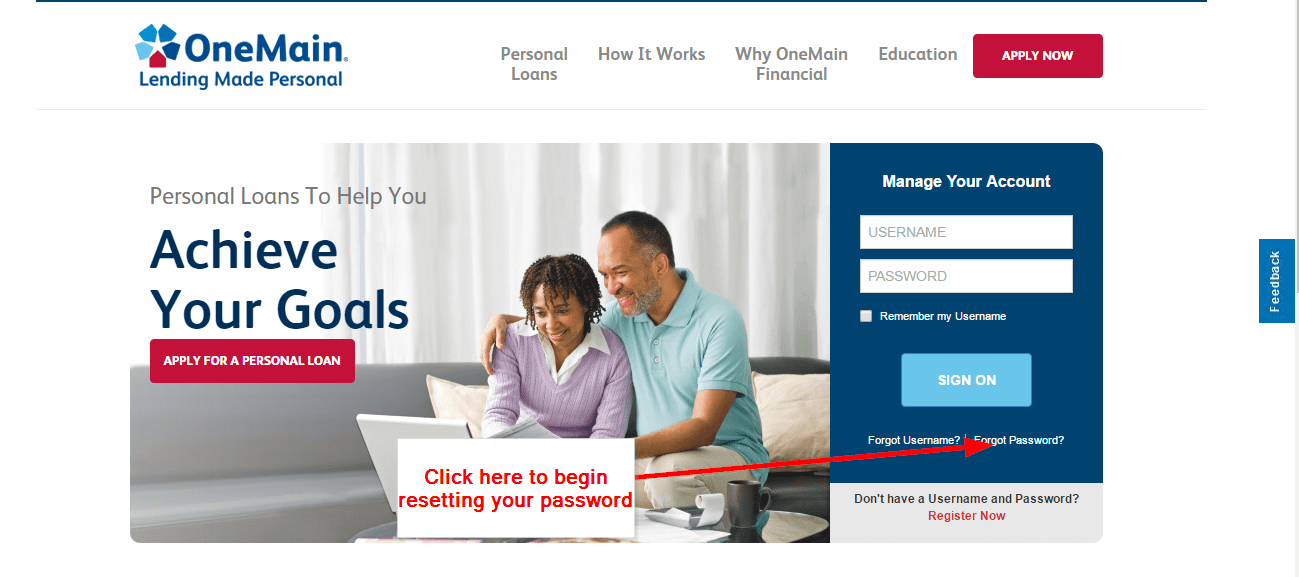

Ideas on how to check your credit history

You can check your current credit history because of a cards reference agency website, particularly Experian. Particular companies provide totally free products, however, be sure to terminate or you will be energized. If you spot a mistake on your credit history causing you having a lesser credit score than simply you ought to, you can request that it is eliminated. Therefore, boosting your chances of providing property guarantee mortgage.

Ought i just take currency away from my house with less than perfect credit?

Which have less than perfect credit, youre prone to be denied a property security loan otherwise HELOC, but it’s perhaps not impractical to be accepted. If you find yourself approved for a guarantee loan having less than perfect credit, the loan rate of interest could be more than should you have a good credit score. This is simply once the bank notices you since a larger chance and much more attending default towards the costs.

Domestic equity funds which have bad credit

For people who check for property collateral mortgage that have less than perfect credit on the internet, there are some loan providers that will be advertisements these specific sizes away from finance. Constantly look around getting a guarantee mortgage that have less than perfect credit as the fresh new costs may vary notably. Those with an unsatisfactory obligations to money ratio may also have these problems.

Ought i rating a house equity financing with no employment?

It might be extremely difficult to obtain property security mortgage while underemployed. The financial institution have to be confident you have sufficient earnings so you’re able to create monthly premiums. Instead of a living, they are not gonna leave you any borrowing from the bank, regardless of what much collateral you’ve got accumulated.

The sole time this is not the scenario is if your has income no wait loans Standing Rock, AL off their sources, for example a pension and you may financial investments.