The fresh new Just what and you can Whys out-of house security fund

To order property has some experts. It isn’t just a roof more than your face. A property also can are designed to become an appreciating and concrete advantage as you are able to influence to achieve different financial goals within some other existence grade.

A number of the alternatives for capitalizing brand new latent property value your own household is partially or fully renting they, offering they, or correct-measurements to some other property. Definitely, this type of examples need you to to improve the life style preparations.

But not, there was an option which enables you to definitely availability the property’s equity instead diminishing their life style plans, which is a property equity loan. I describe right here how property guarantee loan functions in the Singapore and you may what are their positives and you can threats.

Should i increase my home collateral?

The value of your home security is highly influenced by new market value of your property any kind of time reason for the long term. Growth in home collateral you will come from:

- Settling the main equilibrium of your home loan. So it reduces the financial obligation you borrowed from on the financial and you can expands your collateral possession of your home.

- A boost in the new enities on your neighborhood, such as for instance another MRT line, schools, malls, otherwise parks. You might smartly purchase a house that might features instance a beneficial change from the studying area learn agreements.

- Repair and you may remodelling smartly predicated on particular circumstances on your neighbourhood like gentrification or build manner which can desire upcoming renters. However, you’re going to have to budget for the expense of the remodelling and you will guess their payday loans Charlotte profits on return. Note that it way more relevant to upscale private services, particularly landed house and you will luxury condominiums.

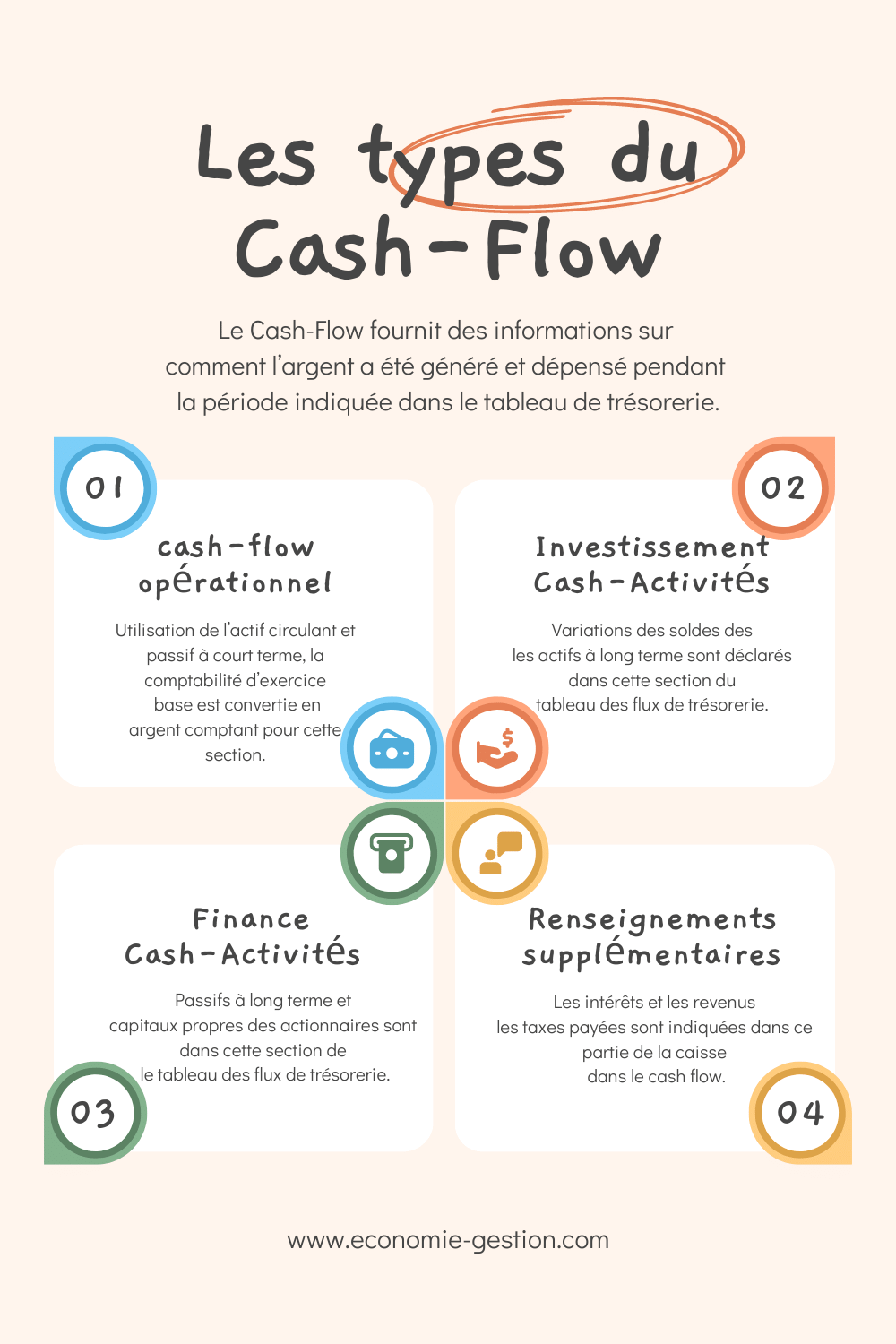

Loan providers in Singapore, around specific laws and you can guidelines, offer that loan up against the security you hold on the assets. Home guarantee mortgage was a guaranteed financing in which your house is made use of just like the guarantee into mortgage. Home owners may benefit in the love of one’s functions and borrow finance secure against the assets to finance the other monetary need such training.

Why: a house guarantee financing against. offering otherwise leasing

When it comes to partly renting your home, you might have to accept a stranger and you may comply with the alterations which may feature it.

For folks who sell your home or lease it out totally, as well as the frictional hurdle out of moving any land, you will have the added exposure and you may will set you back of renting otherwise to acquire a new location to live in. Regarding investing, you’ll find numerous fees, taxation (such as stamp commitments), and you can pre-fee penalties (on your own a fantastic mortgage, in the event the appropriate that you must imagine.

Regarding a home security loan, you have the proceeded benefit of staying in your property when you’re accessing a substantial portion of the property value your home within the cash. Taking up a house collateral loan incurs the speed billed of the bank, plus the duty to pay straight back the borrowed funds timely. If you don’t repay the mortgage instalments punctually or or even standard on your personal debt underneath the financing, the financial institution could possibly get sell the newest mortgaged property to recoup the newest a good amount beneath the mortgage.

Why: a house security loan vs. a consumer loan

Dependent on prevailing sector criteria, a home equity financing may have an interest rate less than an unsecured loan. In the case of a property security loan, it is a protected loan with the assets being the cover, ergo letting you appreciate a reduced interest rate. Create keep in mind that if you don’t pay back the borrowed funds instalments punctually or otherwise standard on the financial obligation under the mortgage, the consequences can vary out-of late fees, negative impact on your credit history and you will likelihood of a foreclosures in poor instance condition.