Fannie mae Home Able Vs Freddie Mac House Possible

That have regulators-recognized mortgage agreements, to invest in property without having to pay a big amount off a lower fee may only take a look it is possible to. not, government-backed providers instance Freddie Mac and you may Fannie mae provides applications that provide lowest-deposit fund. These represent the Freddie Mac Household You can easily and Federal national mortgage association HomeReady financial programs.

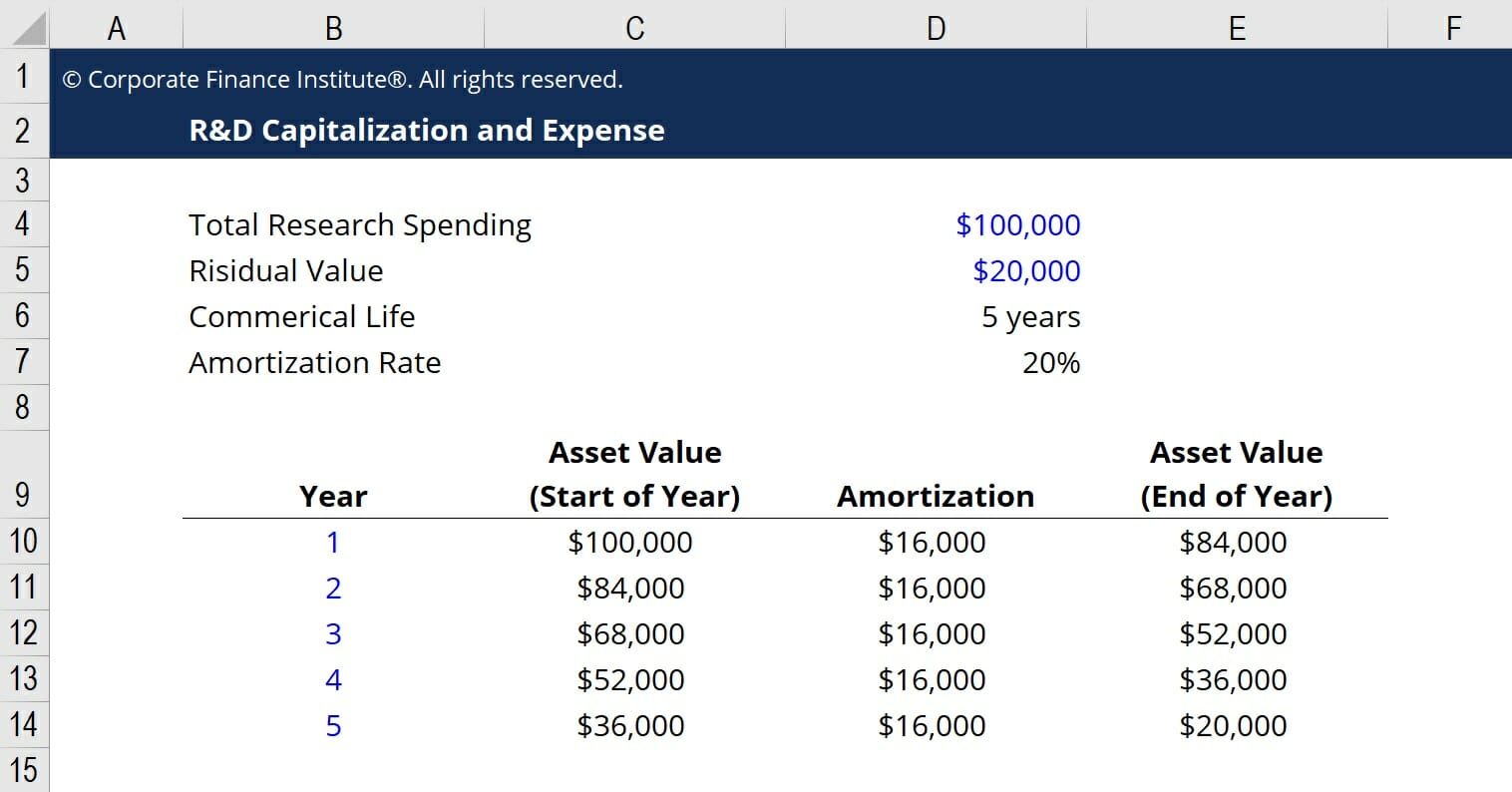

These types of apps promote a beneficial 3% down-payment or a great 97% LTV (loan-to-value) on conventional money. They are typical financing given because of the very lenders regarding the home loan s succeed individuals to place off a little downpayment. The primary distinction is the credit rating criteria. HomeReady means a score out-of 620, when you’re Family You can easily wants a 660 credit score that’ll potentially affect the eligibility toward home loan.

What exactly is Fannie Mae’s HomeReady Financing?

HomeReady of the Federal national mortgage association is actually an interest rate system accessible to both this new and recite homebuyers which have a credit history off from the least 620. Having flexible down payment criteria, individuals only have to spend a beneficial step three% advance payment using one-relatives domestic, which amount can also be partly or completely happened to be a grant or provide. This one is fantastic earliest-date home owners whom usually do not lay large sums of cash since dumps. The three% deposit demands is lower than the newest Federal Houses Management (FHA Finance) commission having money, that is 3.5%. Exactly like other traditional mortgage loans, consumers will have to be the cause of the private financial insurance coverage (PMI) if the an advance payment out of below 20% is made to your HomeReady mortgage.

To make issues easier, the insurance premium is actually reduced to possess consumers which be eligible for Fannie Mae’s loan, permitting them to contain the payment per month lower than an excellent traditional financing.

The fresh new HomeReady money limitations may differ. Together with the main source of income, more forms of income can be used to end up being eligible toward financial, like an excellent co-signer’s income otherwise a great roommate’s money. When your very first step 3% downpayment is actually paid off, then there is a high likelihood of adding an excellent renter’s earnings that could further make clear the method.

The funds limitations regarding HomeReady have decided considering geographical place. Underserved areas do not have eg income constraints, while you are features during the designated crisis and you can highest-minority portion keeps a constraint away from 100% of area’s average earnings.

Key Have And Highlights of The Fannie mae HomeReady Mortgage

- A beneficial 3% down payment will become necessary.

- Lower PMI advanced.

- Types of the newest advance payment include liquids dollars, gift suggestions, grants, and cash off their guidance applications.

- Capacity to fool around with earnings regarding low-renter co-borrowers in order to become eligible.

- Earnings of a roomie should be shown to enhance the options from qualification.

- Leasing earnings of a mother or father-in-laws device or cellar tool are going to be found.

Advantages of the newest HomeReady Financing

- This new HomeReady mortgage is perfect for basic-big date homebuyers because it demands good step three% downpayment that will be acquired courtesy different options. Additionally prefers men and women making a paycheck equivalent to otherwise below 80% of your own area’s average earnings.

- First-day consumers or people who have no prior credit history are expected to-do a Homebuyer training way out of an eligible supply. This supplies brand https://paydayloanalabama.com/florence/ new homeowners together with the necessary data that will help them browse from the techniques so much more smoothly.

- The fresh new freedom to really make the deposit that have cash on give is perhaps one of the many advantages of Fannie Mae’s HomeReady system. Many people save your self the liquids cash in the home as an alternative than at financial. More home loan agreements need to have the debtor to open an effective conventional most recent otherwise bank account, deposit their money and you will expect a minimum of two months, then they want to let you know its lender statements. In addition, HomeReady lets individuals to utilize instantaneously which have particular security confirmation inspections. Despite that, the process is however faster and much more simpler.