If you get a residential property HELOC?

Financing Agents

Loan brokers services given that middlemen ranging from consumers and you will mortgage brokers. They don’t use their funds, nonetheless examine various other lenders and select an offer that fits your position most useful. Brokers run more lenders and can availability different types of mortgages. They’re able to help determine your official certification when taking out a loan.

Measures to apply for HELOC

Applying for HELOC even compares to applying for other mortgage loanspare price quotes to pick a lender and you will submit your financial documents. This is how to get started:

- Assess Your finances. Property beliefs are often increasing. Before you apply having a good HELOC, you must estimate your guarantee. You need to know your property worth instead of the financial equilibrium. The difference between new property’s reasonable market price and you will mortgage harmony equals your security stake.

- Contrast Rate Quotespare the rate rates from other creditors to get better income on a residential property. Particular loan providers costs zero closing costs but higher rates, and you may the other way around. Dictate all round effect of your income to select the main one that meets your position.

- Over The application. Shortly after choosing a loan provider, complete the complete HELOC application. Brand new underwriting process involves possessions appraisals and records of your own money. The lender also explores your money flow, loans weight, and you will supplies. These details dictate the loan count your qualify for in addition to notice charge.

- Wait for Approval. Shortly after the job, approval takes a few days. The fresh lender’s schedule and exactly how quick you answer their inquiries otherwise requirements change the prepared course. Assessment contributes time to the newest recognition processes, nevertheless could work in your favor from the obtaining a higher financing limit.

- Close for the Mortgage. Since final approval are introduced, you should spend the money for closure pricing and signal the last paperwork. Your line of credit tends to be easily obtainable in a short while. The brand new wishing several months is the rescission several months, where you can disappear on the HELOC for folks who changes the head.

- Access Your Credit line. As procedure is finished, you can access your own finance in different implies. Lenders prefer its HELOC funding methodsmon of them were checkbooks, debit cards, as well as in-department dollars distributions. You may also play with electronic transfers on the internet otherwise because of the mobile.

An investment property HELOC will help improve rental earnings otherwise improve your asset’s price. This will be completed if the money are acclimatized to funds property improvements or generate improvements for the investment property. This sooner develops their value, rental income prospective, and also resale rates.

Instead, you can make use of your situated collateral to many other desires. The choice hinges on whether or not you may like to cash out certain of your security or boost the bang for your buck assets.

If you would like change your money spent, you ought to plan assembling your shed costs. Receive several quotes to own assets renovations and other factors to obtain by far the most advantageous you to definitely. Measure the project’s impact on your home prior to making a final choice.

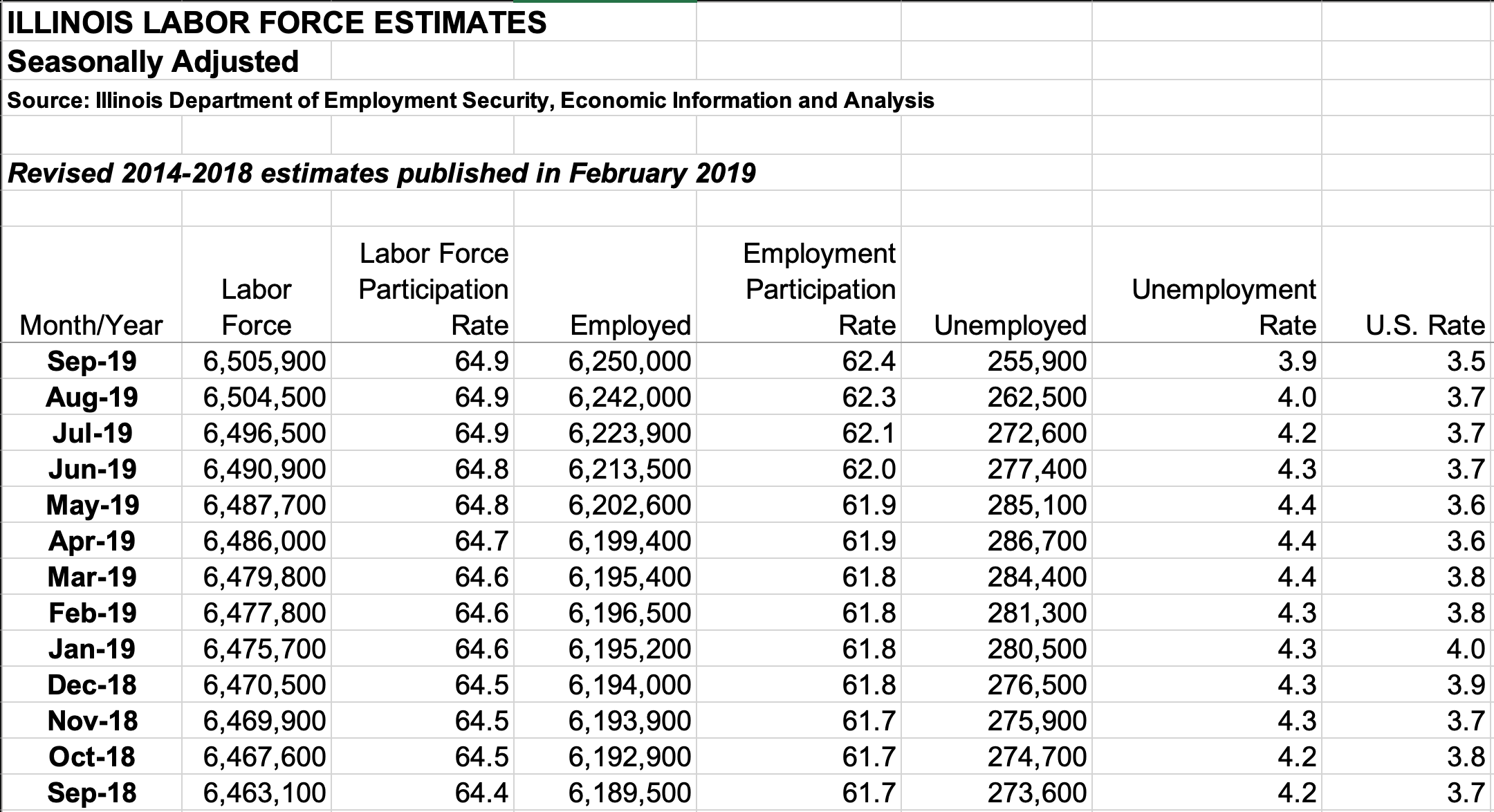

Influence the potential rise in rental earnings and/or conversion rate that the venture provides http://www.cashadvancecompass.com/installment-loans-il/nashville/. Anticipating their return on investment into the leasing property update can help determine the break-actually several months and you may if a great HELOC is a possible choice.

Figuring brand new return on investment is best should you want to renovate market your home. Consulting a realtor and other elite group doing work in financing functions might help determine the worth of a house upgrade project. They may be able including highly recommend ideas for most useful productivity.

HELOC Experts and Dangers

Your investment property is an invaluable wide range source as possible tap. A great HELOC is an excellent technique for doing this. Borrowing facing disregard the home is of good use, nevertheless has its dangers.