The initial step during the starting the borrowed funds software procedure should be to get organizedpile very first data and financial records very early

In some towns today, a property are an effective seller’s sector. Which have several consumers lined up for just one assets, you might lose out on where you can find their hopes and dreams instead of a loan preapproval available.

While you are ranch and ranch real estate revenue elizabeth basic principles still incorporate. By doing your quest before you apply for money, you could put oneself in the a prime position to maneuver whenever the right property becomes offered.

Start very early.

“The procedure for the consumer while the loan officer happens so much more effortlessly in the event that information is bundled up-and complete,” says Justin Wiethorn, Texas Land bank regional chairman. “If the a candidate cannot get it in the, it contributes an extra or third round away from realize-up, hence delays critical processes and certainly will become hard into consumer.”

Wiethorn states he or she is an effective proponent having preapprovals, and in some cases can offer good preapproval which is an excellent to have 6 months. He along with spends this time around to educate consumers who aren’t while the accustomed the loan process towards various parts requisite after, such as surveys, term performs and you can appraisals, so they knows what to anticipate.

Information number.

Within the instances of early in the day delinquencies, tell the truth. Very lenders declare that sleeping otherwise withholding info is among by far the most harmful some thing an applicant is going to do. Factors is often looked after, so remaining the mortgage manager advised regarding start normally rescue crucial date. In addition, it applies when taking a thorough dysfunction of the house being offered as security.

Discover your credit score.

Amanda Simpson, secretary vice president with Alabama Ranch Borrowing from the bank, makes reference to an unfortunate world she’s viewed play in their particular place of work again and again.

“I have had a potential customer have expecting its credit rating become 100 points greater than its, because they don’t realize that a credit file was work on dozens of that time when they was indeed automobile shopping and you may enjoy various investors to get their score, otherwise a healthcare range comes up because of an outstanding expenses away from ages before the applicant does not have any idea is present,” she states. “In our part, i normally do not remove a credit history up until we believe truth be told there are a valid loan application – meaning i’ve a complete statement of finance, credit consent or any other advice based upon the particular demand.”

When you find yourself actual deposit standards may differ, he could be generally speaking predicated on credit items analyzed because of the bank. Wiethorn claims that the community basic having residential fund is 20 per cent, and you can picking out one amount of money are a keen challenge for many people. This is particularly true to own more youthful or earliest-big date borrowers, otherwise individuals who acquired home mortgages having short down payments during the the last few years and may also features trouble transitioning into the community practical.

“Ranch Credit has that loan program having more youthful, delivery otherwise short brands, which has less restrictive borrowing standards to assist them into transition to the farming otherwise ranching,” Wiethorn states. “This includes down-payment standards, together with the power to work on additional supplies, such as the Ranch Provider Department. While you are there are several limits on the accessibility this program, this has been a beneficial unit to aid some young potential borrowers due to their earliest house purchase.”

Learn the “Five Cs out of Credit.”

- Character: the fresh new borrower’s honesty and you will stability

- Capacity: the new applicant’s economic capacity to pay the borrowed funds

- Capital: new applicant’s liquidity and you may solvency

- Collateral: the fresh bodily possessions that get rid of the fresh new lender’s exposure regarding the knowledge away from standard

- Conditions: brand new criteria to possess granting and you will paying down the mortgage

“Brand new ‘five Cs’ could keep you regarding trouble,” Kenneth Hooper, Panhandle-Flatlands Land-bank older vice-president/department movie director, says. “Ranch Borrowing enjoys constantly trapped on them, and i also believe its one reason why our system enjoys succeeded for over 95 decades. It is dated blogs, but it performs.”

Get to know their financial.

Even in the event a candidate wants “approval” off a loan provider during a software techniques, lenders do need to become a group towards applicant. Particularly which have Ranch Credit lenders, Simpson claims that just like the Farm Credit specializes in rural lending, she wants their particular consumers to feel they could call on their unique for many concerns linked to the procedures.

Hooper believes, and you will says you to a great mortgage officer will place much regarding work into the building a robust connection which have users.

“A loan officer ought not to you need to be individuals meeting files,” Hooper claims. “I want for this to-be a long-identity relationship, and would like to feel of use and also as the majority of an information source that one can – today and you may down the road.”

A file List

Given that a number of particular data can differ away from lender to bank, all of the mortgage officials will for the next:

Application and you can most recent statement of finance: Such versions will be provided from the lender. Independent economic statements could well be you’ll need for personal and relevant agencies such as for example partnerships or firms in which the applicant provides an enthusiastic appeal.

Previous 3 years off finished tax returns: Panhandle-Plains Land-bank Elderly Vp/Branch Manager Kenneth Hooper claims that reason for 3 years from production (that is important getting farming financing) isnt discover a ages otherwise bad many years, however, to get fashion in the earnings.

https://paydayloanalabama.com/clay/

Judge dysfunction out-of homes considering because defense: This can include a deed otherwise questionnaire, followed closely by a keen aerial photographs otherwise an effective surveyor’s plat. In case the offered safety was an outlying quarters, a great surveyor’s plat need to be provided.

Discounts and you can borrowing information: The lending company will want copies of the many bank comments, certificates from put, common fund, holds, securities, etc., for each candidate.

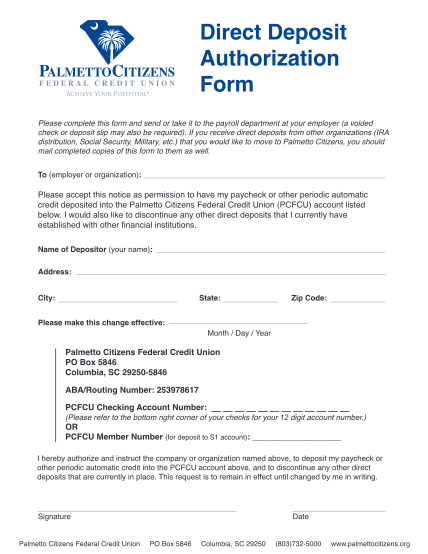

Agreement setting: So it authorizes the financial institution to obtain credit history; employment and you may income verifications; information about assets, obligations or insurance policies; and any other guidance needed to complete the software.

Structure files: An application getting a housing mortgage need certainly to were a whole put out of agreements and you can needs otherwise a duplicate of your own construction bid or price finalized from the candidate additionally the builder.