You to last thing to note towards criteria one to regulate organization borrowing from the bank applicants having disgusting revenue higher than $one million

To possess company credit candidates with gross profits regarding $one million or shorter who apply for borrowing from the bank from the mobile, brand new signal will bring even greater self-reliance. Area 1002.9(a)(3)(i)(C) it allows providing a dental declaration of one’s action drawn and you will an enthusiastic dental revelation of one’s pointers necessary for section 1002.9(a)(3)(i)(B)-all the info in regards to the declaration regarding factors who would or even feel uncovered towards composed borrowing app. This is going to make sense from the complications inside the bringing one composed disclosure about the report regarding factors when you take an application because of the mobile.

Getting people with gross profits higher than $one million from the before fiscal seasons, point 1002.9(a)(3)(ii) needs notifying the organization credit applicant of one’s action pulled within this a reasonable time in lieu of towering the fresh 30-day time requirement out of part 1002.9(a)(1)(i) following acknowledgment of a done software. None the fresh rule neither this new feedback shows you the borders off what constitutes quite a long time, however the statements shows that conforming for the time conditions for consumers-inside 1 month away from bill from a complete software-have a tendency to fulfill the signal. Select, 12 CFR Area 1002, Supp. We, feedback nine(a)(3)-1

As with individuals having gross revenues off $one million or reduced, the financing relationship may provide the new see of your own action drawn by mouth or even in writing. 9(b)(1) if the candidates request in writing the reasons within 60 days of one’s borrowing from the bank union’s notice of the negative step.

It is more easy than what is necessary to own providers credit people having gross incomes from $1 million otherwise shorter. Having said that, the newest comments will bring one to a credit connection can adhere to Regulation B to own bad action sees sent to company borrowing individuals with gross revenue greater than $1 million or “an expansion regarding trade credit, borrowing incident so you can a great factoring arrangement, or other equivalent form of business borrowing from the bank,” if for example the borrowing from the bank connection observe what’s needed one connect with people and for businesses having gross revenue from $one million or smaller. Come across, several CFR Area 1002, Supp. I, review 9(a)(3)-4. Since it may be hard to determine a business credit applicant’s terrible revenue in accordance with the app obtained by credit partnership, Control B brings borrowing union’s to your independence to alleviate most of the organization credit individuals the same. If the borrowing from the bank partnership decides to enjoys separate actions having people, providers borrowing from the bank applicants with terrible income off $one million otherwise quicker, and you can company credit individuals that have terrible earnings higher than $one million are fundamentally a threat-mainly based choice towards the credit union.

Such standards and connect with an expansion out-of trading credit, borrowing event in order to good factoring contract, and other equivalent types of providers credit regardless of the applicant’s gross revenues. The newest opinions will bring a whole lot more information on what comprises exchange borrowing or factoring as contemplated from the area 1002.9(a)(3)(ii). Come across, several CFR Region 1002, Supp. I, statements nine(a)(3)-dos & step 3.

Control B also needs borrowing from the bank unions to provide this type of business borrowing from the bank applicants with a composed report out-of aspects of the brand new adverse step in addition to ECOA find revealed within the point 1002

If you’re NCUA failed to were bad action notices with its listing away from updated supervisory concerns through new COVID-19 pandemic, the new CFPB detailed that its prioritized examination, and therefore apply the fresh CFPB’s targeted supervisory method made to manage the results of your own COVID-19 pandemic, will appear at the how organizations complied with adverse step find standards to possess Salary Shelter System (PPP) loan applications. Look for, Prioritized Assessments Faq’s, Matter 11. If you’re NCUA may or may not improve scrutiny with the conformity having adverse action find requirements to own PPP applications, it can be beneficial to look at your borrowing union’s company credit bad step policies and functions to determine when the discover any holes that needs to be handled.

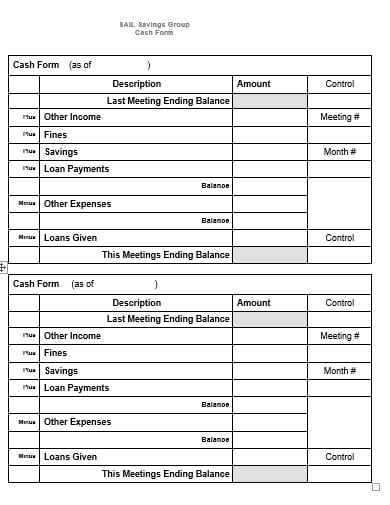

In the event that a credit commitment tries information on which these types of disclosures should look like in rule, then credit relationship will appear so you’re able loan places Brantleyville to shot variations C-8 and you will C-9 for the Appendix C so you can Controls B

Regulation B along with provides borrowing unions significantly more flexibility regarding your statement of certain reasons requirements. Unlike delivering an authored declaration of certain causes because necessary for part 1002.9(a)(2)(i), a cards connection can get divulge the organization borrowing applicant’s straight to an announcement regarding explanations into software when your disclosure contains all the info necessary for point 1002.9(a)(2)(ii) (i.e., straight to found report from certain grounds, time requirements, contact information to utilize within the acquiring the report out-of explanations, to has declaration out-of grounds confirmed in writing in the event the offered orally) and you can area 1002.9(b)(1) (i.age., the brand new ECOA observe).