Your credit score is actually independent from your credit history, though the get try arranged regarding the report

- September 9, 2024

- availableloan.net+payday-loans-de+new-castle bad credit no credit check payday loans

- 0 comment

- admin

And enjoying credit history from the three big reporting bureaus, additionally you will be get your FICO rating. Your score is like a study credit. Fair Isaac & Co. (the brand new FICO get keeper) assigns your several based on the information on your own credit statement. Because there are around three credit-revealing bureaus, you have got three Fico scores. Here you will find the rating items:

Borrowing from the bank Listing

- Commission records – Have you reduced your own costs timely?

- Number owed – What is your current debt?

- Period of credit score – Just how long have you been borrowing from the bank money? Lenders want to see an extended credit rating.

- The brand new borrowing from the bank – Have you removed the fresh credit?

- Form of borrowing used – Loan providers want to see a myriad of borrowing items: charge cards, car and truck loans, student loans, plus.

What is actually an a+?

Brand new Credit ratings include 350 in order to 850; an enthusiastic 850 ‘s the Holy grail of credit scores and you can 723 ‘s the median get on You.S., but you can assume an effective mortgage rates of interest within 720 so you can 760 peak or over.

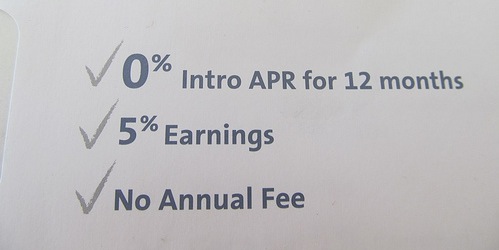

To have anecdotal proof the a good credit score updates, if you see you are receiving a number of zero % charge card otherwise lines of credit also provides, maybe you are inside the pretty good figure.

Homebuyers who go after an FHA financing, one of the most popular loan sizes to possess earliest-go out people, usually can safe financing when the the credit try 580 otherwise more than.

Extremely mortgage lenders have fun with FICO because their technique of deciding their interest rate additionally the type of loan you be eligible for; while the rates of interest creep right up, that it variation is tall.

Free Records

Thankfully that your particular credit history is easy in order to get. A federal controls one ran into the effect inside gets consumers access to just one free credit report per year off each one of the around three revealing bureaus: Equifax, Experian, and TransUnion. The internet declaration is created after you address a few cover issues and simply requires about 10 minutes accomplish.

Your FICO rating is during easy reach as well during the myfico. For every single FICO get costs just as much as $fifteen, but so it costs could possibly get help save you plenty across the lifetime of your own home loan for individuals who end up with a diminished interest.

Credit rating Range

How will you understand what good rating are and you can what a bad get try? Well, that is variety of a grey town just like the various other score is determined in a different way; additional loan providers use various other results, with no one knows exactly how he could be determined since those people formulas try exclusive to the businesses with these people. Score generally speaking include as much as 3 hundred so you’re able to 850 on the mediocre credit history in the usa coming to in the 687. Listed here is an approximate list of just how credit scores are evaluated:

Advanced level borrowing from the bank = 720 and you will over Good credit = 660 so you’re able to 719 Reasonable borrowing = 620 to help you 659 Poor/less than perfect credit = 619 and less than

Just how Credit history Apply to The Financial

Earlier household google search and obtaining pre-recognized to own home financing, check your credit history as well as have your own Fico scores. Why? Your credit score is the single essential little bit of monetary information you have got to get a mortgage at the best interest.

Examining your credit score before you purchase gives you time payday loans New Castle DE no credit check to fix reporting mistakes in order to cleanup your ratings if the he is regarding the deposits. One to financial informs us that it can take to help you ninety days locate erroneous – and you can pricey – guidance out of the declaration, though some prospective individuals say he’s a much reduced benefit.

What’s inside a credit history?

Credit history are a history of your track record of credit and paying banking institutions, creditors, and just about every other lenders. After you apply at borrow money, the financial institution spends the credit are accountable to determine whether you are a safe choice, otherwise a risk. However they feet almost any rate of interest they supply thereon statement as well as the resulting credit rating.

- Credit history. Including account information outline, like your commission history, and you will especially facts about membership which can have been taken to business collection agencies companies. What’s more, it boasts the amount of levels you’ve got and the brand of each, and if you are inside an excellent standing with every.

- That is exploring their borrowing. Any concerns from the lenders otherwise anybody else regarding your credit is recorded as well.

- Any judgments up against your, particularly case of bankruptcy.

- Private information about yourself, just like your tackles (most recent and you can earlier in the day), Societal Shelter matter along with your earlier in the day companies.

- A section to have statements by you, in the event you has actually debated the brand new report knowledge regarding the earlier in the day.

Ideas on how to Request a study

You will find around three biggest borrowing from the bank-revealing companies: Equifax, TransUnion, and you will Experian. You could located a free content of one’s credit history immediately after a-year regarding AnnualCreditReport, and that provides the accounts of all the around three organizations.

It is best if you get a copy per year thus to glance at they getting problems. Errors assortment any where from name misspellings and you can wrong Social Protection number in order to levels getting listed as the nevertheless discover when in truth it was in fact closed – an error that can harm your should you want to get home financing.

Your credit history will also tell you if or not you’ve been the latest victim out of identity theft & fraud. If your information that is personal, just like your Societal Safeguards number, has been altered, the newest report will highlight they.